Fintech Infrastructure 101 - Overview & Market Landscape

Financial Technology (“Fintech”) startups are companies targeting all of the core financial applications including Banking ($7T), Wealth Management ($75T), Capital Markets ($74T), Lending ($8T), Real Estate ($8T), Insurance ($5T), Payments ($2T), and Remittances ($800B).

While diverse in scope, all of these activities are interconnected and largely facilitated through traditional financial institutions including: JP Morgan, Wells Fargo, HSBC, BNP Paribas, MUFG, Bank of America, Bank of China, Industrial & Commercial Bank of China, Citigroup, and many others.

However, many of these new startup fintech startups are being built by developers, who are a very new customer segment for traditional banks and who are changing the needs of the underlying financial infrastructure itself. Before diving into how the infrastructure ecosystem is changing, I will cover the major trends that are the root cause of this change.

Major structural trends in the fintech landscape

Increasing global customer bases

Embedded Fintech

Unbundling of Financial Institutions

Developers as the end customers

Increasing global customer bases

Financial services companies historically have dealt with a limited set of customers across known geographical barriers. Traditional banks started with local, city, regional, state wide, and country-wide offices and worked with international correspondent banks to transfer money across jurisdictions.

Banks were not set up to handle international customer bases, and the regulatory and compliance overhead of sending international payments is a huge sunk cost within the current system. On average it costs ~7% to send remittance payments internationally between retail customers.

In contrast, digital commerce platforms are required to handle international customer bases from day one. For example:

Apple - 1.4B active apple device users across every major continent worldwide.

Airbnb - 650,000 hosts, 150M renters, 2M bookings per day, across 191 countries.

Shopify - 600,000 merchants across 175 countries with $15B in GMV for 2019.

Uber - 3M drivers and 75M riders across 80 countries, with $40B in GMV for 2019.

Binance - 15M users across 180 countries, with $1T in trading volume on the platform and $1B in cumulative profit in 1.5 years of operation.

The financial infrastructure platforms of today must be able to handle customers across all jurisdictions, all exchanges of value, all types of use-cases (producers, distributors, consumers), and all from the start.

Embedded Fintech

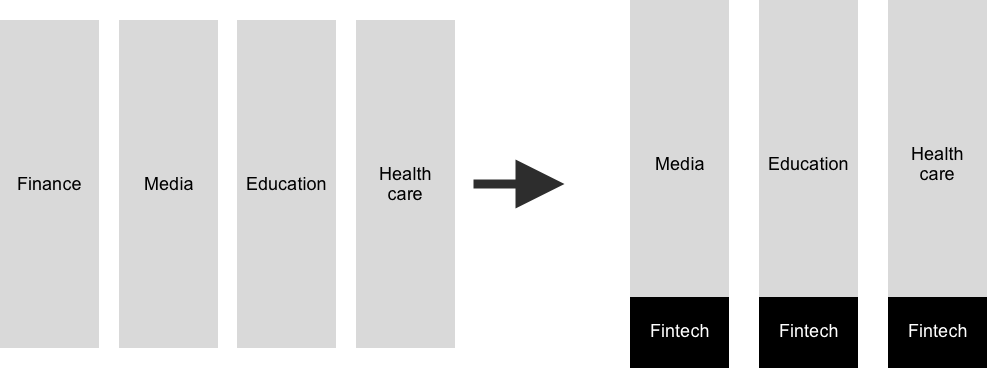

The financial sector and fintechs have historically been thought of as a vertical industry serving specific use-cases (banking, lending, trading, etc.). However we are now seeing the rise of “embedded fintech.”

Rather than standalone applications, financial features are being embedded into all of the consumer and business applications that people are using already. Here are several examples:

Uber - Launching Uber money to allow drivers to collect earnings in real time & issue credit/debit cards to spend their balance.

Grab - Created their own digital wallet to be able to hold and spend value in their digital wallet (similar to WeChat pay).

Google - Now offering checking accounts through Citigroup and Stanford Federal Credit Union.

Facebook - Is trying to launch Libra, one of the more ambitious bets to develop their own digital currency.

WeChat (owned by Tencent) - Has 1B users and does $1B in total daily payment transaction volume via WeChat Pay.

Unbundling of Financial Institutions

Financial companies historically were large monolithic applications that served the entire suite of financial products to all of their customers. For example, Wells Fargo provides all of these services across these segments:

Consumer - Checking accounts, savings accounts, debit cards, credit cards, FX, remittance, and payments.

SMB - Business checking and savings, debit and credit cards, business lines of credit, loans, merchant services, credit card processing, and PoS systems.

Enterprise - Commercial checking, financing, real estate, employee benefits, institutional investment, investment banking, securities, and treasury management.

Original image created by Tom Loverro: https://tomloverro.com/post/102797126721/banking-is-under-attack-heres-a-screenshot-of

As fintech companies started gaining traction, they largely targeted narrow verticals and customer segments. Here is a good visual representation showing how each fintech company is attacking a very specific product segment that Wells Fargo provides:

Traditional financial companies are feeling the pressure from large competitors and small fintechs across every single segment and product category they serve.

Developers as the end customers

Financial institutions were built to on-board people as customers (retail) or business owners as customers (SMB); however, today there is a new class of users needing access to the underlying financial infrastructure these banks use - developers.

Developers not only want access to the data (“Open banking”) of financial institutions, but more importantly want access to the underlying functionality that banks provide.

Prior to fintech platforms, if a developer wanted to start a new fintech company it typically took 2+ years to develop a partnership with a bank before getting up and running. Now we see developers using fintech platforms (ex. SynapseFi, Sila, etc.) to spin up new fintech apps in a matter of hours. This reduction of effort is leading towards a rise in the number of fintech applications in the marketplace.

My prediction is we will see a further continuation of this trend and the financial infrastructure platforms themselves work across a whole network of financial networks including banks, financial institutions, and up and coming digital wallets. These developer platforms will abstract away all of the complexity of working across multiple financial partners, and allow applications of all types to embed fintech services within their products (both fintech and non-fintech apps).

Fintech Infrastructure

All of the above fintech trends and more are pushing the requirements of fintech platforms, most notably by the developers who are building fintech apps on top of the legacy and next-generation financial infrastructure.

Below is a market map of this new fintech financial infrastructure space:

Traditional Financial Institutions

This category includes all of the traditional banks working with fintech companies on a business level (white-label banking), developer level (banking-as-a-service), and the legacy core banking infrastructure providers (FIS, Fiserv, etc). Many of the early adopter banks have been smaller community oriented banks, with the exception of BBVA who developed their platform through the acquisition of Simple.

Banking-as-a-service Platforms

This category is primarily other startups who are trying to provide the entire functionality of a bank (Deposit, Savings, Send, Withdraw) to developers to allow them to build financial features within their own applications.

Banking Connector API’s

This category is primarily platforms and services that allow users to connect their own bank accounts (Chase, Bank of America, Wells Fargo, Citi) through API’s that developers can embed into their own application.

Lending as a Service

This category are platforms who are proving end-to-end lending solutions which can be embedded within fintech applications or work within lenders & financial institutions. This includes some of the traditional players in addition to new startups offering these services via API.

Card Issuing API - Targeting developers

This category is primarily platforms that allow developers to issue cards (Credit card, virtual cards, and prepaid cards) within their applications to their end users.

Brokerage Infrastructure API’s

These are API’s that allow developers to offer stock trading & brokerage services within their fintech applications.

Other Financial Infrastructure API’s

Here are a few examples of other fintech infrastructure companies allowing developers to build stock trading, marketplace, and other complex forms of payments within their applications.

Banks vs. Developers

Many of the tools, API’s, and infrastructure created for financial applications were originally created for internal banking customers; however, now with the rise of consumer and business fintech applications, we are going to see outside developers as the new emerging customer.

Plaid, a fintech infrastructure company recently acquired by Visa for $5.3B, stated in their M&A report that they have 2,600+ fintech developers on the platform. As we see more and more products embedding financial features into their own applications, we’re going to see a huge expansion of “fintech developers” across all market segments and verticals.

Thanks

A big thank you to Charley Ma, Mengxi Lu, Edith Yeung, Jason Choi, David Gogel, and Kim McCann for helping to review and provide feedback on this post.

Appendix

“Future evolution of fintech infrastructure”

Fintech applications are most commonly thought of as being built on top of existing banking systems.

However, as this infrastructure layer is solved there are new banking rails which are still in their infancy - most notably digital assets. This includes Bitcoin, Ethereum, and most interesting of all, the variations of Stablecoins (USDT, USDC, etc.).

Given digital-assets are programmable in nature, many of the first order problems are already solved from day one. Digital assets are stored in a common data layer (the blockchain), with a shared interface (UXTO’s or ERC20’s), and build on inter-operable protocols (assets can be stored among any digital wallets).

There is a huge open question whether digital-asset first platforms (Coinbase/Binance) will be able to bridge these divides first, or whether traditional fintech apps will move down the digital stack first.

This cross-section is one of the most interesting areas we are paying attention to closely.