Crypto Mining 101 - Overview & Landscape of the Mining Industry

As of July 2019, Bitcoin miners generate $6B+ in revenues (mining rewards + transaction fees) on an annualized basis.

Mining and the underlying hardware that secures Bitcoin and other cryptocurrency projects is an often overlooked market within the cryptocurrency sector. However in conjunction with the exchange landscape, mining is one of the core markets which generates significant revenues.

In this post I will share an overview of the Bitcoin & crypto mining space, the underlying hardware which powers mining, an ecosystem landscape, and dive into the revenue & market size of the space.

How Cryptocurrency Mining Works

Proof-of-work (mining) is the process in which new transactions are added to the Bitcoin blockchain and how the correct order of such transactions are agreed upon (consensus).

One of my favorite analogies of the process is to think of it like a sudoku puzzle. It’s a puzzle that takes a lot of brainpower to solve, but once it’s solved it's very easy for everyone else to verify that you have found the correct answer.

This video below gives one of the best visual representations to more intuitively understand how blocks are created, chained together, how transactions are added into the blockchain, and how mining plays a central role in this process:

Essentially, miners (computers geographically distributed around the world) compete to solve a computationally intensive puzzle which verifies the next block in the blockchain (in addition to the underlying transactions within the block). The miner who solves this puzzle first is the person who is able to claim the reward (the “coinbase reward” + transaction fees). Once the next block is found all of the miners on the network are able to verify that the block is correct, and move onto solving the next block in the chain.

The Role Miners Play in the Bitcoin & Crypto Ecosystem

All of the computers around the world racing to solve the next puzzle are the participants that make up the mining ecosystem. The collective computational resources are one of the core ingredients which provides the underlying security guarantees Bitcoin provides.

Through this network, Bitcoin participants are able to expect:

Their transactions will be confirmed on the Bitcoin blockchain.

Their transactions will be in the correct order (protect against double spends).

The history of the Bitcoin blockchain will stay intact (immutability).

In return miners are compensated both in newly minted Bitcoin (“coinbase rewards”) + the transaction fees associated with each transaction. If participants want stronger guarantees on when their transaction will be added to the Bitcoin blockchain, they can increase the transaction fees they are willing to pay for their transactions.

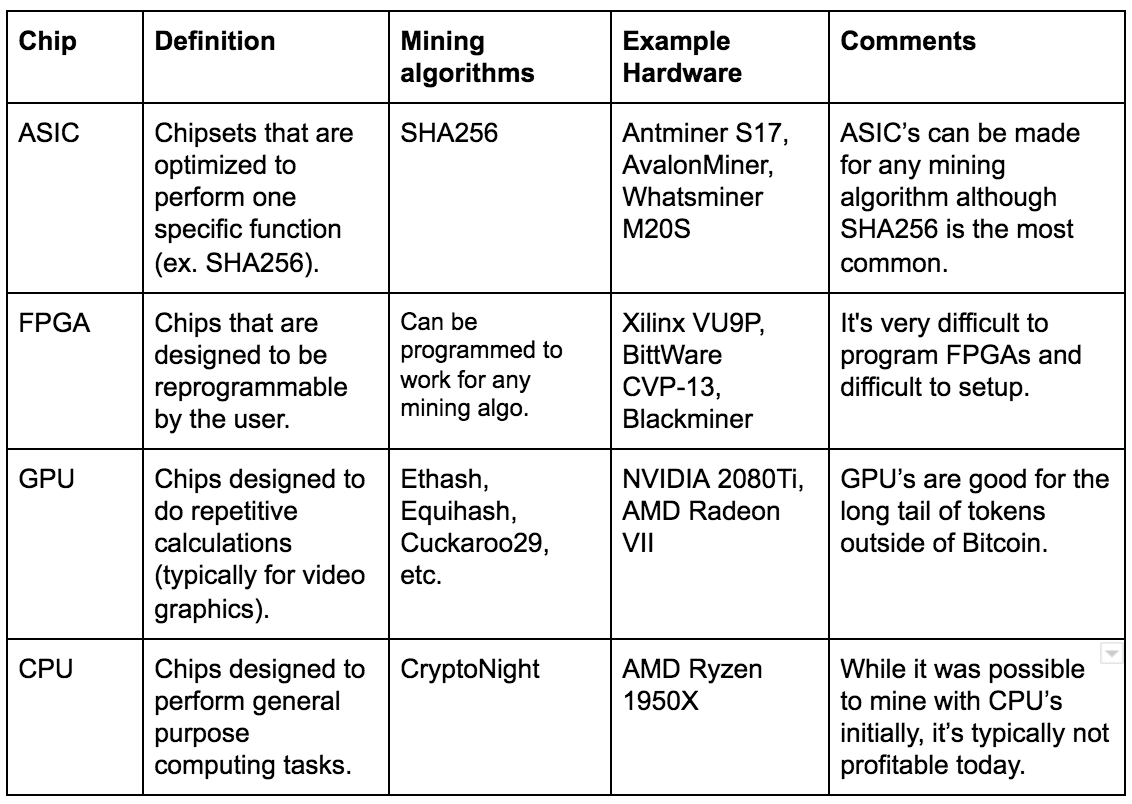

Hardware Used in Mining

While in the beginning of the Bitcoin network, it was profitable to mine Bitcoin using consumer grade central processing units (CPU’s), the Bitcoin network has developed to such a scale where it is impractical to do so now.

The Bitcoin ecosystem is largely dominated by application specific integrated circuits (ASIC’s). For most other cryptocurrencies, graphics processing units (GPU’s) and field-programmable gate array (FPGA's) are the dominant form factors. A number of coins also exist with the same hashing algorithm at Bitcoin (SHA256) that are compatible with Bitcoin mining ASICs.

Mining Ecosystem Landscape

Below is a graphic of the mining sector in its totality, from the chips to the end user services:

Foundry

Taiwan Semiconductor (TSMC) and Samsung are the two core semiconductor foundries which produce all of the silicon wafers which go into mining hardware. Taiwan 🇹🇼in particular has a dominant share of the chipset supply chain.

For example: NVIDIA, AMD, Xilinx, Bitmain, and Cannan all use TSMC for their core production lines.

Packaging, Testing, Assembly

Once the wafers are complete you need to test them, cut them apart, package them into the final chip, and retest. This whole process is typically handled by OSAT companies (outsourced assembly and test companies) with the two largest of such being ASE Group (Taiwan) and Amkor Technology.

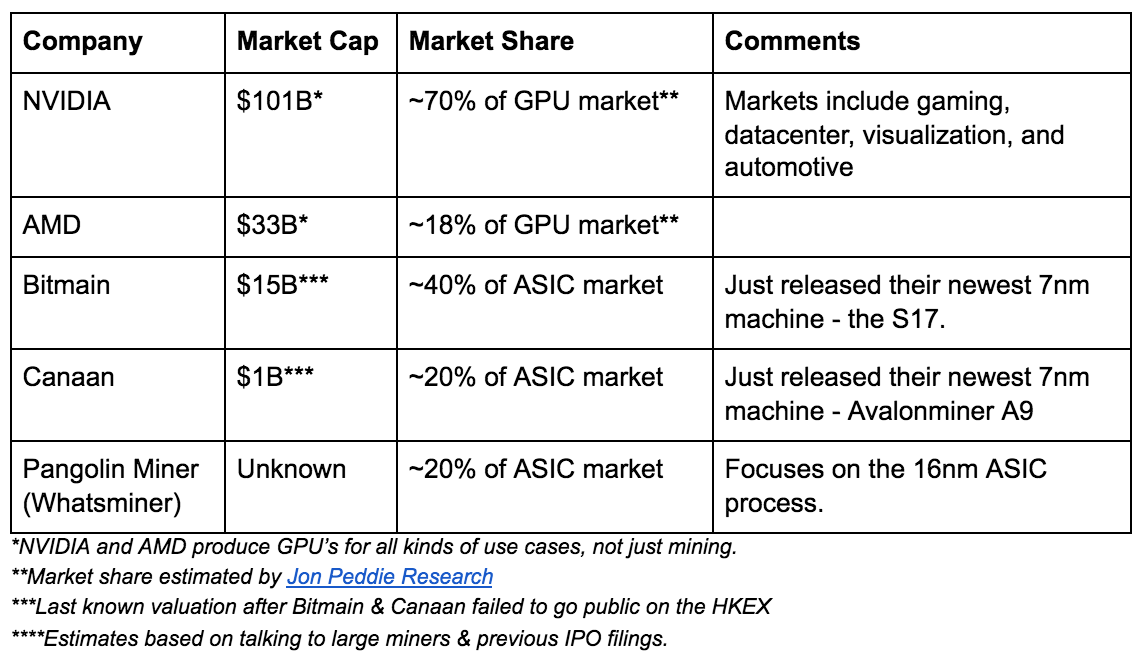

IC Design and Manufacturers

The companies which design and sell the chips are typically referred to as fabless chip companies (the fabrication itself is left to the foundry and OSAT companies).

For GPU’s, the two top manufacturers are NVIDIA and AMD. For FPGA’s, the top manufacturer is Xilinx. For crypto specific ASIC’s, the top three companies are Bitmain, Canaan, and Pangolin Miner (producer of the Whatsminer line).

In addition to these three manufacturers there are other IC design companies in the space including: Ebang, Innosilicon, Bitfury, Obelisk, and others.

Miners & Mining Farms

After the chips have been produced, they can now be used to mine cryptocurrencies. ASIC’s are especially designed to mine one mining algorithm (typically SHA256 & Bitcoin) while GPU’s have more flexibility built in.

Miners include: people using one machine to mine, small mining operations (5-10 machines), medium sized mining farms (10-100 machines), large scale mining operations (100-1,000 machines) to industrial scale mining farms (1,000+ machines). Some of the largest operations I’ve heard of so far are in the range of 100,000’s of machines across multiple geographies.

In addition to designing the chips some of the manufacturers mine themselves as well (Bitmain, Canaan, Pangolin). Bitmain, for example, publicly discloses their “self-mining” monthly.

Any sized mining operation can be pointed at a mining pool (more on these later) or if large enough they can self mine - aggregating all of their hashpower to find blocks directly, without commingling their hashrate with other miners.

*It is quite controversial that the mining chip producers potentially use their own machines to mine before selling them. However if you really do have a device that generates revenue, there is no reason why you would leave it unused in inventory, but rather you would utilize it until you could sell it.

Pools (Single and multi-currency)

For individual to non-industrial miners it is more economically rational to join a pool rather than to self mine. Pools aggregate the hashpower of many miners together to smooth out the reward curves for each individual miner. The pool is in charge of optimizing all of the hashpower, running the mining notes, collecting & distributed rewards, and taking a fee on top for the service.

There are some pools that specialize in specific cryptocurrencies (Sparkpool: Ethereum & Grin) and other pools which have setup various pools covering all of the top cryptocurrencies (Antpool, F2Pool, Poolin, Slushpool, etc). All of these pools started by specializing in one cryptocurrency (typically Bitcoin) and have thus expanded to cover all forms of cryptocurrencies.

One of my favorite analogies of how mining pools work is to think of it like the office lottery pool. By pooling together all of the lottery tickets, all of the individuals (miners) have a better chance of winning the reward (block reward).

However with mining pools you are both trusting the service to both report the correct earnings and the correct number of tickets everyone in the pool has. To bring transparency there are services like PoolWatch that try to track and compare the reporting across various mining pools.

Hashrate Marketplaces

As a miner in addition to using your own hashrate for mining, you also have the option to sell your hashrate to someone else. Often, this is done in a marketplace - the biggest of such marketplaces is NiceHash. A smaller, peer-to-peer marketplace is Mining Rig Rentals.

On these marketplaces, people can both sell their hashrate and/or purchase hashrate on any given set of mining algorithms across any kind of cryptocurrencies. Although there are a lot of reasons why someone would want to buy hashrate, one of the top reasons is buying hashrate is used as a form of onramp into cryptocurrencies.

Often times people are using hashrate to speculate on various cryptocurrencies — e.g. want to purchase SHA256 hash rate and use it for Bitcoin SV instead of Bitcoin. (a terrible trade…)

Cloud mining

Cloud mining are services where consumers can purchase hashrate contracts directly, instead of operating any hardware themselves. It’s similar to the hashrate marketplaces above the cloud mining services typically are operated by one central supply.

Two of the biggest companies in this space are Genesis Mining (US) and Bitdeer (Asia). Again similarly to above one of the top reasons is buying hashrate is used as a form of onramp into cryptocurrencies. Through this method, people can use fiat to purchase Bitcoin and other cryptocurrencies directly without going through an exchange.

Smart Miners

Smart miners is a new category that has emerged. Mining is a complex endeavor in which participants need to have an understanding of hardware, networking, energy, forecasts of hashrate, optimizing for specific algorithms, etc. On top of this, all of these inputs are constantly changing on a daily basis with new long tail cryptocurrencies constantly coming and going.

Smart Miners, like Honeyminer, aim to optimize all of these factors to allow miners, both consumers and professionals, to earn as much as possible with the hashpower they have. Two other similar products are HashFish and Cudo Miner.

In a short period of time these products have aggregated a considerable amount of the supply side hashpower of the marketplace.

Size and Revenue of the Mining Market

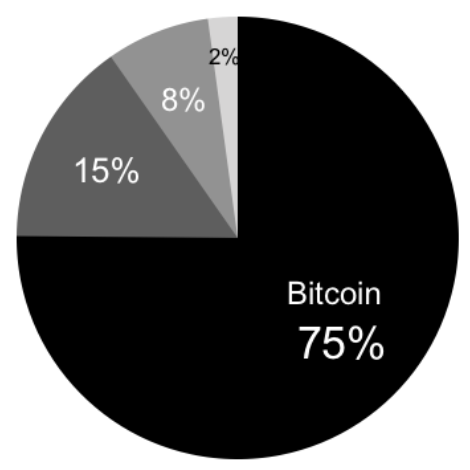

The crypto mining industry generates over $8 billion in revenue on an annualized basis.

Revenue comes from both the block rewards + the transaction fees included in every single block on all proof-of-work blockchains. Based on the most recent CoinMetrics data on June 25th, 2019 the mining rewards, here is the weekly, monthly, and yearly revenue run rates of mining in total.

In the world of cryptocurrency mining, Bitcoin still dominates with 75% of all of the mining revenue being generated by the Bitcoin network alone.

This also matches Bitcoin’s dominance by market cap where today (July 1st, 2019) Bitcoin comprises 60% of the total market cap of all cryptocurrencies according to CoinMarketCap.

However the overall revenue the mining sector generates is directly tied to the price of the underlying cryptocurrency, so it is highly reflexive back to the underlying cryptocurrency market (hence why Wall Street will have a tough time understanding the companies in this sector). More on this below.

Understanding the Profitability of the Mining Sector

The overall revenue, cost, and profitability of participants in the mining sector is hinged on a few key factors.

Capital Expenditure (Capex)

The main capex expense for miners is the cost of the mining machines themselves + any facilities/buildout which are needed to run the operation.

For example if you wanted to purchase 10,000 of the most recent Bitmain S17 models, this would cost $16M at retail price. Large miners can get special pricing; however, when machines are highly in demand it’s hard to even secure supply much less negotiate on rates.

This does not take into account the cost of setting up the facilities which have turned from hobbyist activities into real professional industrial scale operations.

Operational Expenditure (Opex)

The main opex expense for miners is the cost of electricity to power the machines on a daily basis.

For example. if you were running 10,000 Bitmain S17 miners 24/7 this would cost you $36,000 per day (~$13M per year) in energy cost at $0.05 per kilowatt hour (kWh) - just to power the miners alone.

The average cost of electricity is highly variable based on where you live and what electricity source you are using:

Miners are inherently incentivized to find the cheapest sources of energy around the world, which is why Coinshares estimates that 75% of the energy that powers the Bitcoin network comes from renewable sources, largely hydroelectric energy.

In addition to the energy costs to power the mining machines, the other ongoing opex costs include: cooling, staff, maintenance, security, and general facility operations. A general rule of thumb is to 1.5x the energy cost to give a rough estimate on the ongoing opex costs.

Following our example above for a mining operating of 10,000 Bitmain S17 a rough estimate on the cost side would be:

$16M Capex + $3M (import tax) + $4M (Facilities + security)

$20M Opex (yearly)

$67M Revenue potential (based on today’s Bitcoin price).

This is a rough estimate just to show the scale of factors miners are dealing with. The true cost would be highly dependent on your geographic location, buildout, etc.

However even these factors are always in flux, due the the market factors which will we will cover below.

Market factors

While opex and capex are two factors miners can control, there are market forces at play which greatly determine the profitability of mining.

Miner costs & available supply

Unlike many traditional products, the mining producers (Bitmain, Canaan, Whatsminer, etc) will vary the price on the mining machines based on the profitability (the Bitcoin price) of the machines.

During big pull runs the price swings of the underlying cryptocurrencies + the mining machines themselves can swing wildly. In crazy periods there are whole secondary markets dedicated to just purchasing more hardware, and older machines can even become profitable again too.

In general I would always expect the price of machines to be priced close to the fair value the machine can generate at that point in time.

On top of this mining hardware tends to be supply constrained, especially with the newer machines. In keeping with our Bitmain S17 example, these machines are entirely sold out. Talking to some of the people on the team they don’t expect to have supply available until November at the earliest.

Hashrate

The chance of a miner solving the next block is directly proportional to their hashrate relative to the hashrate of the total Bitcoin network (using Bitcoin as an example for simplicity).

An oversimplifying example to illustrate this is if you as a miner controlling 1% of the Bitcoin hashrate (compared to the overall Bitcoin hashrate) then you would expect to earn 1% of the total rewards from the Bitcoin network.

However, the overall hashrate of the Bitcoin is always changing so the profitability of each miner depends on how many miners enter or leave the ecosystem. The Bitcoin protocol does have an internal method on adjusting the difficulty level (to learn more about this, go here).

Bitcoin Price

Since the block reward is paid out in the underlying cryptocurrency. For example if you are mining Bitcoin, the block reward you earn is paid out in Bitcoin itself. Given this the reward amount is directly tied to the price of Bitcoin itself.

The more Bitcoin is worth, the more mining rewards are worth. To engage in mining you have to be inherently long the cryptocurrency you are mining, because your profitability is dependent on it.

One of the major reasons why Bitcoin is the dominant cryptocurrency (outside of being first) is Bitcoin’s transparent, open, and fair supply schedule. From the genesis block, Bitcoin has a fixed supply schedule with a fixed supply - there will only be 21M Bitcoin ever created.

Mining is the way new Bitcoin are created and emitted into the world. Today each Bitcoin block reward is 12.5 Bitcoin; however, this amount decreases every 210,000 blocks. At block #630,000 (estimated around May 24th, 2020) this reward will drop to 6.25 Bitcoin - this is referred to as the halvening event.

To see how halvening events have affected the Bitcoin and other cryptocurrency networks before, check out this great post by CoinMetrics looking at prior halvening events.

If you would like to go even further into the supply schedule of Bitcoin and what happens after all of the Bitcoin is created, see these two posts about Bitcoins supply and overall security budget (shoutout to Dan Held for covering this topic throughly).

TLDR - The price of Bitcoin and underlying supply schedule of Bitcoin greatly affects the profitability of mining itself.

My Key Takeaways

After diving deep into the cryptocurrency mining space here are my biggest takeaways:

While often overlooked the mining industry & underlying hardware plays a very important role in blockchain networks.

Hashrate = cryptocurrency = money. For many people hashrate is the key on-ramp into the crypto world.

Just like we see the financialization of Bitcoin, I predict we will see a similar financialization of hashrate.

If you are an entrepreneur working in this space building marketplaces, exchanges, financial products, or any related services within the mining industry I’d love to chat with you. My contact info is listed on our fund website: Proof of Capital.

A big thank you to Edith Yeung. Noah Jessop, Jane Wu, and a few other large miners who prefer to stay anonymous for providing feedback on this writeup.