Digital Asset Custody — Primer and Landscape

This post was originally written on May 18th, 2019 on Medium.

Note — I originally wrote this writeup on the Digital Asset Custody industry in February 2019. I’m releasing a redacted version of this writeup publicly. All of the numbers and stats in this article were from February.

Cryptoassets (excluding private companies) are a $130B industry. While substantial, the market is in its infancy compared to broader financial markets. In order for cryptoassets to continue growing they must be able to support the needs of institutional investors and financial institutions. There are many blockers preventing this growth, with digital asset custodianship being one of the biggest ones.

Compared to the traditional financial infrastructure of transfer agents, central security depositories, custodian banks, and stock exchanges — the digital asset custody landscape is very different in terms of participants, structure, and underlying assumptions.

This document provides a short introduction on how custodianship within digital crypto assets is unique, and give a landscape of the existing participants in the market.

Quick Primer on Storing and Securing Crypto Assets

Cryptoassets are held and secured via a public-private keypair.

The public key is your public address in the blockchain system (similar to an IP address).The private key is the secret key which gives you access to your assets on the blockchain.

A blockchain wallet is simply a storage system for your private key. A wallet doesn’t “store” any data about your assets — all of that is retained on the blockchain itself.

If needed, here is a quick primer on how a blockchain works.

Why Custody of Crypto-Assets is Different

Cryptoassets are bearer assets in the sense that the control of the private key equates to control of the asset. If the private key is lost (or stolen) this equals to the entire loss of the cryptoasset itself. In other words cryptoassets have a very high asymmetric risk profile.

The best analogy for traditional finance is to think of the private key as a physical stock certificate. Just as the destruction of the physical stock certificate, in the past, would erase all knowledge of ownership, this is the equivalent to the loss of private keys today.

Contrast this within traditional finance where this form of risk is completely offloaded to large custodians, the insurance markets, and ultimately the government who backs many of the asset classes. This type of assurance does not exist within the crypto market today.

We believe there are many important business to be built in providing best-in-class security and custody for cryptoassets. In all other fields we have realized the importance of security and a stable base upon which more innovation can occur. That is even more true in the cryptoasset market.

Custody Landscape

There are broadly three types of places where people store their cryptoassets today:

Exchange wallets

Exchanges are the most common place where retail investors store their crypto-assets. It is mentally easier to leave your assets on the exchange removing the need to worry about private-key management. However, since 2011, there have been ~40 exchanges hacked with more than $7B stolen from exchanges (some of these stolen by the exchange operators themselves).

On top of obvious losses there are three other core concerns for institutional investors for using exchanges as their custody providers:

Counterparty risk — Exchanges have previously done forced liquidations and socialized losses on contracts.

Commingling of assets — Exchanges (even reputable ones) do not segregate user accounts and all assets are commingled with one another. This is especially troubling for cryptoassets where all historical movements are tied to the asset and recorded on the blockchain.

Rehypothecation — If exchanges are lending out assets or running reserve based system, this would imply there are more claims on ownership than cryptoassets outstanding.

For all of these reasons it is highly reccomended that if you hold any significant sum of capital via cryptoassets you should either self custody the assets or use a 3rd party custodian which comply to higher institutional standards.

Hardware Wallets

Exchange wallets

Exchanges are the most common place where retail investors store their crypto-assets. It is mentally easier to leave your assets on the exchange removing the need to worry about private-key management. However, since 2011, there have been ~40 exchanges hacked with more than $7B stolen from exchanges (some of these stolen by the exchange operators themselves).

On top of obvious losses there are three other core concerns for institutional investors for using exchanges as their custody providers:

Counterparty risk — Exchanges have previously done forced liquidations and socialized losses on contracts.

Commingling of assets — Exchanges (even reputable ones) do not segregate user accounts and all assets are commingled with one another. This is especially troubling for cryptoassets where all historical movements are tied to the asset and recorded on the blockchain.

Rehypothecation — If exchanges are lending out assets or running reserve based system, this would imply there are more claims on ownership than cryptoassets outstanding.

For all of these reasons it is highly reccomended that if you hold any significant sum of capital via cryptoassets you should either self custody the assets or use a 3rd party custodian which comply to higher institutional standards.

Hardware Wallets

Hardware wallets are small USB-like hardware devices that store your private-keys in an air-gapped manner from your computer. In this way even if your computer is hacked, the private keys are still safe within the hardware device itself. Hardware wallets are good for retail-users; however, they are not very ideal for institutional owners of crypto assets where you have more than one user who needs access to assets.

Custody Providers

Custody solutions have been created to fill the gap between retail and institutional buyers of cryptoassets. A few firms building solutions in this space include Fidelity Digital Assets, Coinbase Custody, Anchorage, Bakkt, and others.

Custody providers are ideal for:

Institutional investors

Investors who require more than one individual to have access to assets

Generally customers who need more fine grained access control, permission settings, operational controls, multiple levels of authentication, multi-user access, reporting, etc.

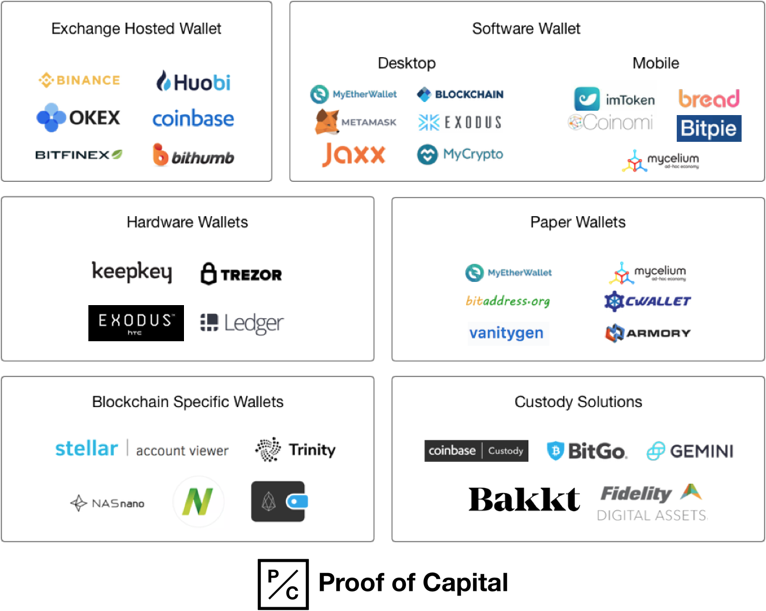

Here is the whole macro level view on the wallet space to see how custody providers fit into the landscape:

Digital Asset Custody Landscape

Here is a deeper dive into the institutional custodian market for crypto-assets:

Institutional vs. Retail Market

Currently the entire crypto-asset is mostly represented by retail users — institutional investors make up a very small portion of the market (Estimate ~3% of the market). One of the core reasons why this is the case is because there has not been a trusted custodian developed yet, both Fidelity’s and Bakkt’s solutions are still under development.

Outside of custodianship there are many infrastructure items required for institutional adoption, including: tax and accounting solutions, portfolio management, portfolio reconciliation, portfolio tracking, prime brokers, etc.

Until more of this infrastructure is developed we will not see meaningful adoption by institutions for crypto-assets.

Why now?

Custodianship has long been identified as a need for crypto-assets. Crypto-assets are a $130B industry and we are starting to see the leading edge of institutional interest with Fidelity, the NYSE, Goldman Sachs, and JP Morgan leading the pack.

On top of this, there is already a small base of crypto-asset hedge funds ready to jump start as beta customers, fund development, validate the market, and prove out a custodian solution. As institutional platforms and demand comes on-onboard, this market will expand greatly.

Owning trust for institutions using crypto-assets is a center of gravity that may have power over many valuable areas of crypto. In a sector where trust is scarce, custodians could become the interface for all institutions to the rest of the blockchain world.

Appendix

Future Evolution of “custodianship”

Custodianship for crypto-assets today is most commonly talked about in terms of the the basic core aspects — securely storing and providing access to assets.

As this fundamental layer is solved there are new concepts, well understood in the traditional financial world, which will bridge over into the blockchain world. Today, functions such as proxy voting, dividends, token splits, and tax reporting are not yet standardized functions for crypto-assets.

Given crypto-assets are programmable in nature, in the future, custodianship will not be merely a cost center, but rather the means by which customers interact with the markets.

Typical Process of Buying and Selling Crypto Assets

Unlike traditional financial assets, crypto-assets have a different set of processes buyers must typically follow when purchasing, holding, and selling crypto-assets.

Here is an example diagram of one such process and how the custodian fits into this process. Keep in mind this process would be different if you are interacting with an over-the-counter (OTC) desk or acquiring directly from a counterparty.

Note — Keep in mind this was written before XRP was listed on Coinbase, so the process is simpler now :)

As you can see, each transaction is a multi-step process where each step must be completed with zero errors. If a public address is entered incorrectly, this would result in loss of funds (because crypto-assets are bearer instruments).

The key for crypto-asset custodians is the tradeoff between usability and safety.

Usability: Ease and readiness of use

Safety: Absence of catastrophic consequences and losses.

If you never needed to use your crypto-assets (hold forever), securing them is not particularly difficult. However, the risk of custodianship increases significantly the more you want to actively use them. Risk is proportional to a number of factors including:

Amount of money: The amount an attacker is willing to spend on getting access to your keys, is proportional to the amount they’d make by compromising your keys.

Amount and frequency of transactions: The more you need to actively use your crypto-assets whether sending, staking, or selling them — the more opportunity there is for them to get compromised.

Amount of employees: The more people you have at your company interacting with and using the cryptocurrencies, the more attack surface area there is as well as room for mistakes or theft by employees.

Amount of novel activity: The more outlier events like forks, security flaws, and airdrops occur, the more your custodianship solution must keep pace and evolve.